Binary options

Binary options promise quick, high returns. But the reality is you will lose your entire investment most of the time. Binary options are financial products

Binary options promise quick, high returns. But the reality is you will lose your entire investment most of the time. Binary options are financial products

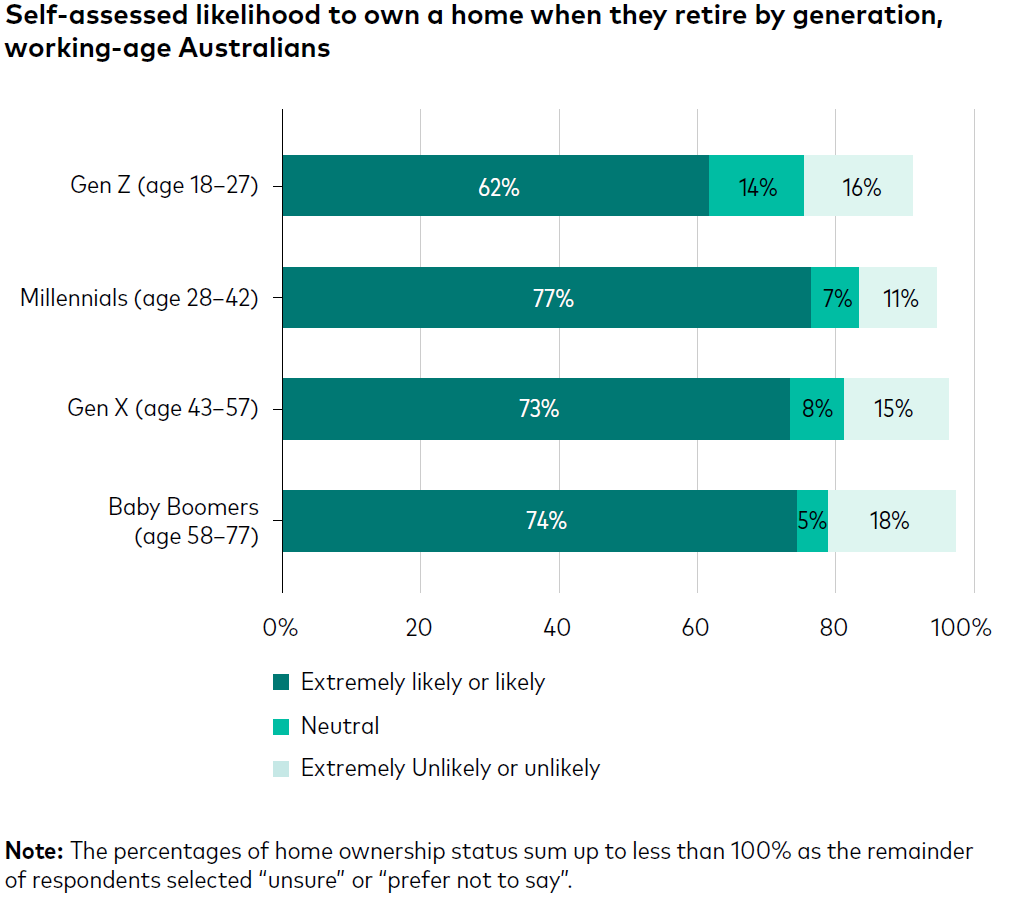

Retiring without a mortgage has a large positive impact on retirement confidence. For decades the “Great Australian Dream” has been the general desire by most

Key points: Getting an assessment is the first step towards getting access to Government funded services Assessments are undertaken by the Aged Care Assessment Team

Gold prices have been climbing strongly in 2024 as investors, jittery about the effects of wars in the Middle East and Ukraine, buy up the

Rather than worrying about day-to-day price movements, focus here instead. If you checked on the status of your investment portfolio today, don’t worry. You’re definitely

1. Make a budget It can be surprising just how much you need to spend before your baby even arrives. There are services and classes

Refinancing your home loan has the potential to save you thousands, reduce your monthly repayments and free up your finances to achieve your goals. However,

Discounts, offers and rewards programs Cost of living is impacting people across Australia, with everything from rising interest rates to the weekly grocery shop contributing

The rules around making some types of super contributions have been relaxed in recent years, so it’s worth exploring the different opportunities available to you

Different loan repayment types When you apply for a home or investment property loan, you may have the option of one of these repayment types:

If you have more than one loan, it may sound like a good idea to roll them into one consolidated loan. Debt consolidation (or refinancing)

Teaching kids about money The truth is, adulthood is rife with financial challenges. The more prepared your children are, the better. From budgeting and saving,